How to read the BB Sigma Index (Yin-Yang Index)

Chart Reading Example

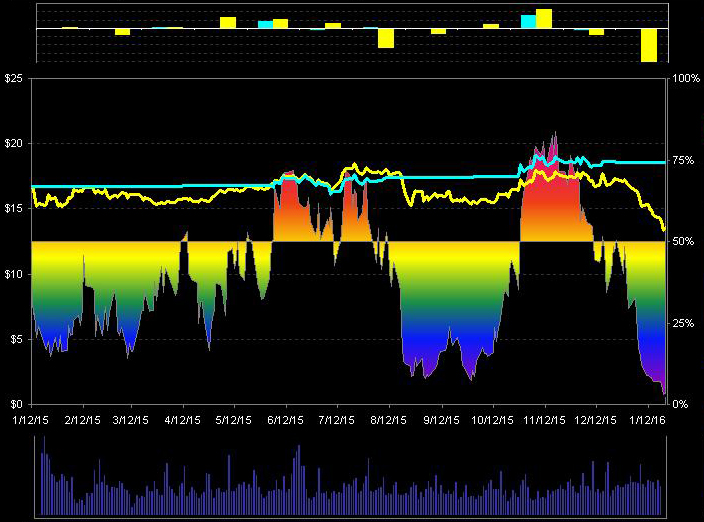

BAC Intermediate Yin-Yang Index

BAC Intermediate Yin-Yang Index

Part 1: Center

|

1. Middle part is the main chart.

3. Bottom part illustrates the daily volume. |

Part 2: Top

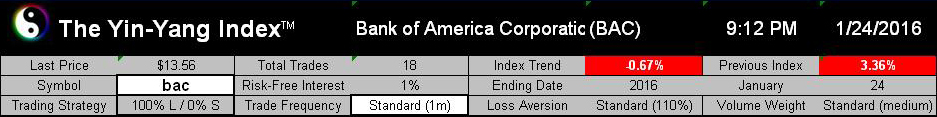

- Top right shows the time and date when the Yin-Yang Chart is created;

- "Last price" is the last trade price for BAC ($13.56);

- "Total trades" shows how many trades are made when applying the Yin-Yang Trading strategy (18);

- "Index Trend" gives the Yin-Yang Index Change when the current index is compared to yesterday's index (-0.67% or getting more bearish);

- "Previous Index" is yesterday's closing Yin-Yang Index value (3.36%);

- "Symbol" field can enter any stock ("BAC" shown here) or ETF symbol to obtain the real-time Yin-Yang Index Chart;

- "Risk-Free Interest" is the interest assumed for cash parked when Yin-Yang trading is in action;

- "Ending Date" is the input for the one-year chart ending date which is normally set as current date;

- "Trading Strategy" is set default as 100% long based on Yin-Yang crossing and it can be set as long/short strategy to increase leverage;

- "Trading Frequency" here is set as Standard which will give Intermediate Trend chart (Long-Term Trend uses "Years" and Short-Term Trend uses "Days");

- "Loss Aversion" setting is 110% which means investors is 10% emotional overweight to loss vs. gain;

- "Volume weight" can be changed to overweight or underweight volume effect on the Yin-Yang Index value.

Part 3: Right

|

Part 4: Bottom

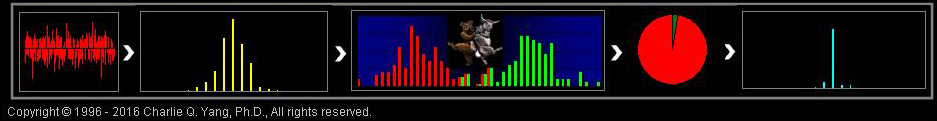

- The left part (red noise chart) is the actual statistical sampling of the BAC trading price changes;

- The Yellow single-mode bell chart shows traditional way of presenting the price changes to calculate mean (return) and standard deviation (risk);

- The middle red/green chart is the resulting dual-mode distribution after statistical processing using the CMBT Theory;

- The Pie chart shows the resulting Yin-Yang calculation which illustrates the Yin (bear) is clearly in control for BAC stock (most in red);

- The right blue chart with a narrow single-mode chart shows if the Yin-Yang Strategy is applied, the resulting return/risk is much better than the Buy-and-Hold strategy (shown in the yellow single-mode chart).